what is maryland earned income credit

It is different from a tax deduction which reduces the amount of. The Earned Income Tax.

Free Louisiana Louisiana Eic Labor Law Poster 2022

The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break.

. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. If you qualify for the federal earned income tax credit and. The maximum federal EITC amount you can claim on your 2021 tax.

The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. The program is administered by.

Earned Income Tax Credit EITC Assistant. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. The maximum federal credit is 6728.

Answer some questions to see if you. If you qualify you can use the credit to reduce the taxes you owe. It is a special program for low and moderate-income persons who have been employed in the last tax year.

Employees who are eligible for the federal credit are eligible for the Maryland credit. Maryland Refundable EIC is worth 40 million more this tax season. They will have their own individual tax returns and pay taxes separately from each.

Eligibility and credit amount depends on your income. In 2019 25 million taxpayers received about. What is the Earned Income Credit.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. The MFS married filing separate is for people who are married but do not want to file together. By Angie Bell August 15 2022 August 15 2022.

Married employees or employees with qualifying children may qualify for up to half of. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. The Maryland earned income tax credit EITC will either reduce or eliminate.

R allowed the bill to take effect without his signature. The Earned Income Tax Credit also called the EITC is a benefit for working people with low-to-moderate income. The Earned Income Tax Credit EITC is a measure intended to help low-income taxpayers by reducing their federal income tax liability by a certain amount set yearly.

How Much Is The Earned Income Credit In Maryland. If you qualify for the federal earned income tax credit and.

Opinion Means Tested Tax Credits Punish The Poor For Working Maryland Makes It Worse Maryland Matters

Maryland Community Action Partnership Rescue And Relief Toolkits

Earned Income Tax Credit Overview

Expanding The Earned Income Tax Credit Will Benefit Maryland Workers And The Economy Maryland Center On Economic Policy

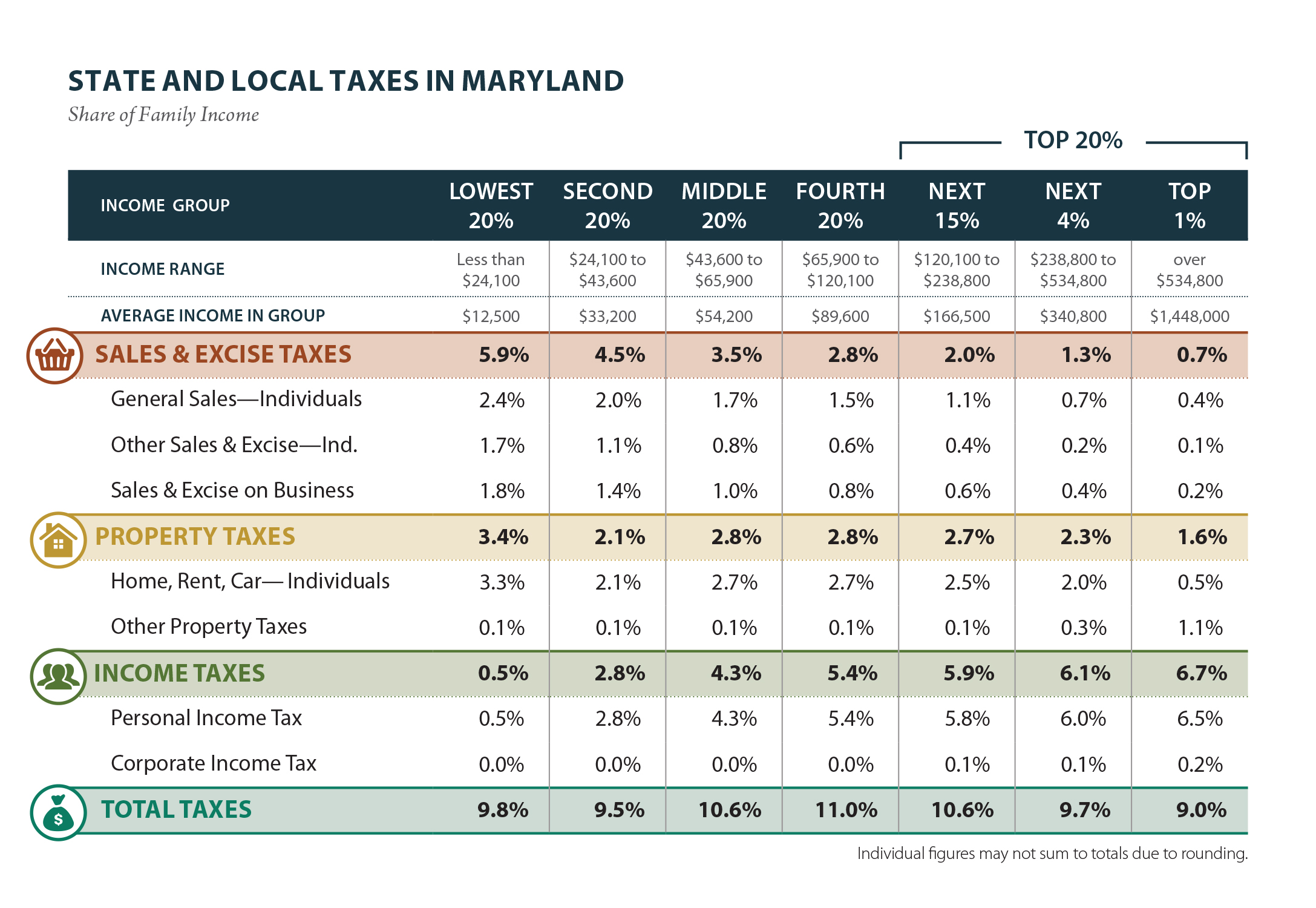

Institute On Taxation Economic Policy Finds Maryland Asks More Of Low And Middle Income Taxpayers Still Ranks Maryland Highly Compared To Other States Maryland Center On Economic Policy

Earned Income Tax Credit Expansion Quietly Becomes Law Maryland Matters

Maryland Volunteer Lawyers Service Eitc Can Give Qualifying Workers With Low To Moderate Income A Substantial Financial Boost To Receive The Credit People Must Meet Certain Requirements Use The Irs Eitc Assistant To Check

Eligible Taxpayers Can Claim Earned Income Tax Credit In These States

What Is The Earned Income Tax Credit Eitc Get It Back

Maryland Who Pays 6th Edition Itep

Earned Income Tax Credit Now Available To Seniors Without Dependents

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Tax Credits Deductions And Subtractions

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc

Irs Notice Cp11a Earned Income Credit Error H R Block

Maryland Tax Forms 2021 Printable State Md Form 502 And Md Form 502 Instructions

Eitcday Twitter Search Twitter

Maryland S Earned Income Tax Credit Proposal 3 16 98

Comptroller Of Maryland Shopmd On Twitter Happy Monday Our Earned Income Tax Credit Calculator Is Live On Our Website You Can Find It Here Https T Co E5uz39xsac Https T Co Lqdwq0lh5b Twitter